Why is the efficient frontier a parabola?

If you want to know more about Efficient Frontier Parabola

When it comes to optimizing your investment portfolio, understanding the concept of the Efficient Frontier is crucial. In this article, we will delve into the Efficient Frontier and its characteristics, answering the question of why it forms a parabolic shape.

Efficient Frontier: Overview

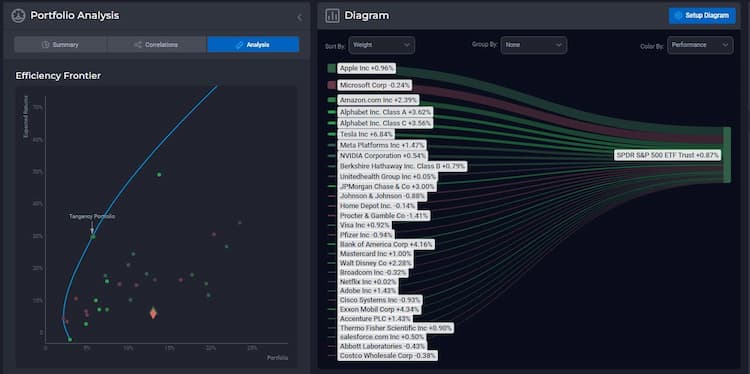

The Efficient Frontier is a fundamental concept in finance that represents the combination of assets in a portfolio that offers the highest expected return for a given level of risk or the lowest risk for a given level of expected return. It is a graphical representation that helps investors make informed decisions about asset allocation.

Efficient Frontier: Parabolic Nature

One of the key attributes of the Efficient Frontier is its parabolic shape. This shape is a result of the trade-off between risk and return in a portfolio. Initially, as you increase the allocation to higher-risk assets, the portfolio's expected return also increases. However, at a certain point, adding more high-risk assets doesn't significantly boost returns, but it significantly increases the portfolio's risk. This is where the parabolic curve begins to slope downwards, indicating diminishing returns for higher risk.

Efficient Frontier: Optimizing Returns

To calculate the Efficient Frontier, financial professionals use mathematical models and historical data to identify the optimal mix of assets that maximizes returns for a given level of risk. This optimization process involves careful consideration of asset correlations, volatility, and historical performance data.

Efficient Frontier: Practical Tools

For investors looking to calculate the Efficient Frontier for their portfolios, there are efficient frontier calculators and tools available. These tools allow you to input various asset classes, their expected returns, and volatilities, and then generate the optimal portfolio mix that lies on the Efficient Frontier. Utilizing these tools can help you make data-driven investment decisions.

In conclusion, the Efficient Frontier's parabolic shape is a result of the delicate balance between risk and return in a portfolio. Understanding this concept and how it is calculated can help investors optimize their portfolios for better risk-adjusted returns. However, always remember that while the Efficient Frontier is a valuable tool, it's not providing any investment advisory services.

Get startedFAQ

What is the Efficient Frontier?

The Efficient Frontier is a concept in portfolio theory that shows the set of optimal portfolios offering the highest expected return for a given level of risk.

How is the Efficient Frontier determined?

The Efficient Frontier is derived mathematically by using statistics like expected returns, volatility, and correlations between different assets in the portfolio.

Should I aim for a portfolio on the Efficient Frontier?

Aiming for a portfolio on the Efficient Frontier is generally advisable as it offers the highest return for a given level of risk. However, it depends on your investment goals and risk tolerance.

Are portfolios on the Efficient Frontier always profitable?

While the Efficient Frontier represents the set of optimal portfolios, it does not guarantee profitability. Market conditions can affect the returns.

Can the Efficient Frontier change over time?

Yes, the Efficient Frontier can change as market conditions, asset correlations, and other variables evolve.