How does the SSO ETF work?

The SSO ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The PIZ issuer, which is the Invesco ETF, adheres to a strict investment strategy dictated by its underlying index. Managed by Dorsey Wright & Associates, LLC, the Index Provider selects securities based on a proprietary methodology centered around identifying robust relative strength characteristics. This approach involves assessing factors like a security's performance against the broader market or its relative strength value over a set period. The Underlying Index consists of large-cap equities from developed markets, excluding the United States, with approximately 100 securities selected based on their relative strength scores. The Fund employs a full replication strategy, mirroring the composition of the Underlying Index. While it aims for diversification in line with regulatory requirements, it may transition to a non-diversified status due to changes in market capitalization or index weighting. The Fund also adheres to a concentration policy, focusing its investments in specific industries only if the Underlying Index reflects such concentration. As of October 31, 2023, the Fund showed significant exposure to the industrials sector, with its portfolio holdings subject to periodic adjustments.

PIZ Dividend, as part of the Invesco ETF family, operates within the framework of its underlying index, managed by Dorsey Wright & Associates, LLC. The fund's primary objective is to invest at least 90% of its assets in securities constituting the Underlying Index, which comprises large-cap equities from developed markets, excluding the United States. Dorsey Wright employs a meticulous selection process, emphasizing securities demonstrating robust relative strength characteristics. PIZ Dividend utilizes a full replication strategy to track the Underlying Index, investing in all constituent securities in proportion to their weightings. While aiming for diversification in accordance with regulatory guidelines, the fund may transition to a non-diversified status due to changes in market conditions. Furthermore, the fund adheres to a concentration policy, focusing its investments in specific industries only if mirrored by the Underlying Index. As of October 31, 2023, PIZ Dividend exhibited significant exposure to the industrials sector, with its portfolio holdings subject to periodic adjustments to maintain alignment with the underlying index's composition and objectives.

PIZ Tracking, as an integral component of the Invesco ETF family, operates under the meticulous guidance of Dorsey Wright & Associates, LLC, the designated Index Provider. The fund's primary objective is to closely mirror the performance of its underlying index, which is meticulously curated based on securities showcasing robust relative strength characteristics. This index primarily consists of large-cap equities from developed markets, with exclusion criteria pertaining to the United States. Leveraging a full replication methodology, PIZ Tracking endeavors to invest in all constituent securities in proportion to their weightings within the underlying index. While adhering to regulatory guidelines on diversification, the fund remains agile to shifts in market dynamics that may necessitate adjustments in its composition. Furthermore, PIZ Tracking maintains a concentration policy, directing its investments towards specific industries in line with the composition of the underlying index. As of October 31, 2023, the fund's exposure to the industrials sector was notably significant, indicative of its commitment to faithfully tracking the performance of the underlying index while managing risk and maximizing returns for investors.

PIZ Correlation, as an integral part of the Invesco ETF family, meticulously tracks its underlying index, managed by Dorsey Wright & Associates, LLC. The fund's primary goal is to closely correlate its performance with that of the underlying index, which comprises large-cap equities from developed markets, excluding the United States. Employing a full replication strategy, PIZ Correlation invests in all constituent securities in proportion to their weightings within the underlying index, ensuring alignment with its performance. This approach is bolstered by Dorsey Wright's expertise in selecting securities demonstrating robust relative strength characteristics. While maintaining a focus on regulatory diversification requirements, the fund remains adaptable to changes in market conditions that may warrant adjustments to its composition. PIZ Correlation also adheres to a concentration policy, directing its investments toward specific industries as dictated by the underlying index's composition. As of October 31, 2023, the fund displayed significant exposure to the industrials sector, reflecting its commitment to closely correlating with the underlying index while aiming to optimize investor returns and manage risk effectively.

PIZ Sector, as part of the Invesco ETF family, operates under the expert guidance of Dorsey Wright & Associates, LLC, entrusted with managing its underlying index. The fund's core objective is to meticulously reflect the performance of its designated sector within the global market. Leveraging a full replication strategy, PIZ Sector invests in all constituent securities within its sector in proportion to their weightings, ensuring a precise alignment with the sector's performance dynamics. Dorsey Wright's rigorous selection process emphasizes securities demonstrating robust relative strength characteristics, enabling PIZ Sector to capture the sector's potential growth opportunities effectively. While adhering to regulatory standards for diversification, the fund remains responsive to market shifts, making necessary adjustments to its composition to optimize performance. PIZ Sector also adheres to a concentration policy, focusing investments on specific industries within the sector, as reflected in the underlying index. As of October 31, 2023, the fund exhibited significant exposure to select industries within its sector, demonstrating its commitment to accurately representing sector performance while aiming to deliver optimal results for investors.

PIZ Exposure, as a vital component of the Invesco ETF family, operates under the meticulous oversight of Dorsey Wright & Associates, LLC, entrusted with managing its underlying index. The fund's primary objective is to provide investors with exposure to specific market segments or themes, aiming to capture potential growth opportunities within those areas. Leveraging a full replication strategy, PIZ Exposure invests in all constituent securities within its target market segments or themes in proportion to their weightings, ensuring precise alignment with the desired exposure. Dorsey Wright's rigorous selection process emphasizes securities demonstrating robust relative strength characteristics relevant to the chosen market segments or themes, enabling PIZ Exposure to effectively capture their potential upside. While adhering to regulatory standards for diversification, the fund remains adaptable to market dynamics, making necessary adjustments to its composition to optimize exposure and potential returns. As of October 31, 2023, PIZ Exposure demonstrated significant exposure to its designated market segments or themes, reflecting its commitment to providing investors with targeted exposure to specific areas of opportunity while managing risk effectively. results for investors.

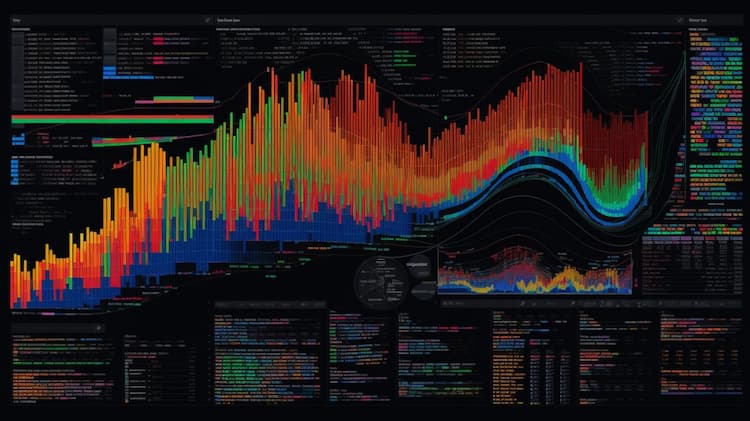

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The SSO ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The PIZ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The ETF with Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.